Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

How 2023 ended, and what this says about 2024

If 2023 taught us anything, then it’s to expect the unexpected.

Senior Journalist, covering the Credit Strategy and Turnaround, Restructuring & Insolvency News brands.

As the metaphorical door closed at the end of last year, you could be forgiven for feeling vaguely optimistic about the state of the economy going into 2024, with inflation falling to 3.9% in November – the ninth successive fall and dropping by more than a half since the start of the year.

These falls also led to the Bank of England pausing its near two-year run of bank rate increases – currently frozen at around 5.25%, with further decreases expected this year.

But if you thought 2023 may have ended on a positive note – think again, with the Office for National Statistics’ (ONS) inflationary figures, published earlier this week, showing there was an – albeit small – but surprise increase in CPI inflation in December.

This rise to four percent came – according to the Office for National Statistics – because of prices rising by 0.4% between the two months. This was the same rate to one decimal place during the same period last year.

Another driving factor of this jump has been the rise cigarette and alcohol prices, up by 12.8% in the year to December 2023 – compared with a rise of 10.2% in the year to November. This, in turn, has meant prices have risen by 1.2% between November and December – compared with a fall of 1.1% between the same two months a year ago.

This can, however, be put down to an increase in the tobacco duty after the government announced higher taxes in their autumn statement – meaning tobacco prices rose by 4.1% between November and December, leading to an annual increase of 16% on prices.

This coincided with, what is described by Hargreaves Lansdown’s head of personal finance Sarah Coles, a small rise in inflation in the “fairly wayward” recreation and culture sector.

One positive hidden within increases has been the continued drop in food and non-alcoholic beverage prices year-on-year, dropping from 1.6% to 0.5% between November and December. This came alongside the annual inflation rate easing for the ninth consecutive month to eight percent in December, and down significantly from the high of 19.2% seen in March.

However, as was pointed out by Coles, this is very different from prices coming down – as they’re still eight percent higher than this time last year and 26% more over the course of two years.

The CPI figures also came just a week after the ONS published what could best be described as a mixed set of GDP figures, as while the economy was estimated to have grown by 0.3% in November, this effectively brought the economy back to square one after the unrevised fall of the same figure in October.

More concerningly still, GDP was estimated to have fallen by 0.2% in the three months to November when compared to the three months to August – with only the services sector not reporting a drop in growth over this period. And even then, there were significant falls seen in food and beverage services and tourism sectors.

This, according to Wealth Club investment analyst Nicholas Hyett, shows there’s evidence the cost-of-living crisis continued to squeeze consumers.

They added: “The lack of a clear economic narrative will make things challenging for the Bank of England, which has the unenviable job of bringing inflation under control while, ideally, not crushing the economy under the burden of interest rates that are too high. While we think it’s unlikely that there’s strong reasons to hike rates from here, rate cuts look unlikely as the UK moves away from recession, at least in the short term.”

This would not have done anything to ease fears that the UK ended last year in a technical recession.

Signs of optimism?

Despite this rather pessimistic end of 2023, there are signs that 2024 could begin to see shoots of optimism – albeit rather tentative.

Whilst writing this piece, EY ITEM Club published its first set of forecasts for 2024 – upgrading its growth forecasts for this year when compared to its previous predictions, going from 0.7% to 0.9%. This coincides with a jump in growth it expects to see in 2025, going from 1.7% to 1.8%.

This comes alongside a far punchier prediction than most around inflation, with its predictions suggest inflation will fall to the Bank of England’s two percent in May, while averaging around 2.4% throughout 2024.

This improved outlook is expected to lead to bank rates being cut by between 100 and 125 basis points this year, with this expected to begin in May.

The improved picture is also expected to be reflected in the house prices, albeit more modestly with these predicted to broadly flatline throughout 2024. This is in stark contrast to the latest figures which suggest UK house prices decreased by 2.1% in November with an average price of £285,000 – £6,000 lower than it was 12 months ago.

And – following a relatively stable end to 2023 in employment terms – improving economic sentiment and the flexibility of the labour market should mean the unemployment rate will only peak at around 4.7%.

It also expects consumer spending to grow by 0.9% throughout 2024 – driven by nominal household incomes comfortably outpacing inflation, while lower energy prices will ease cost-of-living pressures.

This all comes even though it remains possible, and increasingly likely, that the UK slipped into a technical recession in the last quarter of 2024.

What about the government bond market?

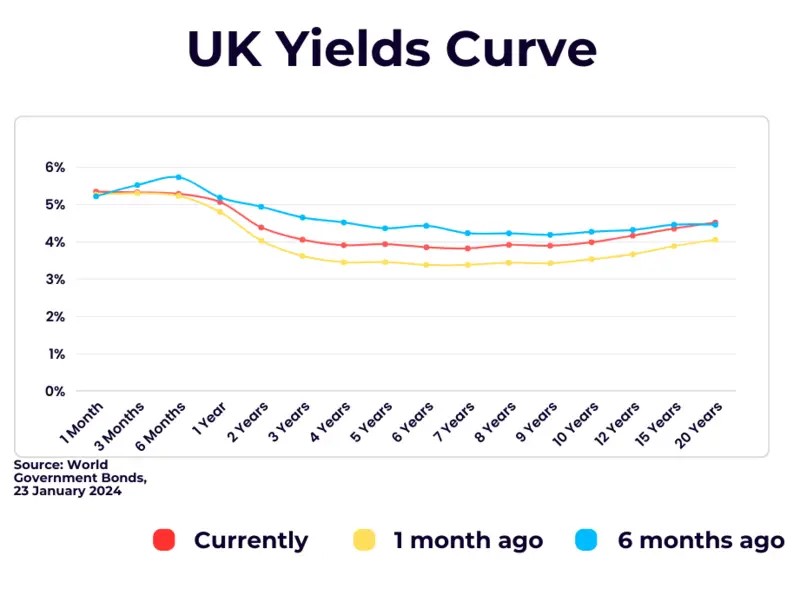

Now while most of this forecasting paints a positive if a bit of bumpy picture for 2024, there is one caveat – and that is that government bonds are currently experiencing an inverted yield curve.

In the simplest terms, a yield curve is a line which plots the yields – or interest rates – of bonds that have equal credit quality but differing maturity, with the slope typically predicting future interest rate changes and economic activity.

Writing in her column earlier this week, the Financial Times’ US markets editor Jennifer Hughes explained them as: "Normally, the longer the term of a bond, the higher the yield as investors seek compensation holding the debt at a greater time and the extra risk that entails.

"When the yield curve inverts, yields on short-term bonds rise above longer-term ones. It has been seen as a harbinger of bad economic times because it implies expectations that interest rates will be lowered in the longer term to stimulate growth."

At the time writing, the difference between two- and 10-year government bonds are set to drop by 38.6 basis points – going from 4.339% to 3.954%. The interest rate on three month and 10-year bonds, meanwhile, are expected to fall by over one percent – falling from around 5.2% to 3.9%.

It is important to add that inverted yield curves should be used with caution when predicting a future recession, as other factors of supply and demand in the debt instrument market may also need to be considered when deducing the reasons behind an inversion.

Having said all of this, it’s likely the economy will break out of near two-year malaise at some point between the middle and the end of this year, and maybe – just maybe – we’ll resorted to some form of normality in the not too distant future.

Stay up-to-date with the latest articles from the Credit Strategy team

Get the latest industry news