Get the latest industry news

Permission Statement

Leadership for the changing times

1904: for many, American business is an act of survival. Every day, hard graft and struggle determine whether basic subsistence needs like food, water and shelter are met.

A young lawyer moves his family from Minnesota to Oklahoma, aiming to become an independent oilman. Little does he know he’s about to become a pioneer of the Gusher Age, the first American oil boom. When a few wells produce results, the lawyer-oilman expands his business. In just two years, Minnehoma Oil Company ravenously acquires other oil wells. By 1930, its owner – George Getty – has become the richest man in America, worth between $10M and $15M ($210M USD in 2017).

Surely this type of business growth and expansion is the benchmark for American business leadership in M&A Corporate Finance?

Think again.

To merge and acquire, Getty approached independent well owners with a ‘fair’ offer. If they didn’t accept he would leave, then return late at night to set their wells on fire provoking an uncontrollable blaze. In the morning he returned to see what bargains he could purchase. Those who did not have resources to control the fire where offered his help in exchange for ownership at a rock-bottom price. Do not pass a twenty-first century judgment on Getty’s pre-industrial ‘M&A’ tactics. This is what everyone did at the time to expand. There was no due diligence, no banks, lawyers, rules and regulations. Leadership was defined by dominating and exploiting others’ weaknesses at any cost, and Getty was just better at it than everyone else.

The concept of what leadership is (and is not) in corporate finance has changed radically over time. Leadership is obviously no longer the same as in Getty’s day – so today, what exactly is it?

Modern-day leaders in corporate finance are faced with a multiplicity of leadership theories, models and approaches about how to effectively lead. Since 1968 alone, over 77,000 books have been published on the general topic of leadership. If you were asked to lead a team or an entire M&A organisation, which leadership approach do you use?

Do you lead like the traditional patriarch of a family office business and only surround yourself with people you trust and know? Be individualistic driven and dominate, Getty-style, by exploiting the market’s weaknesses? Would you develop a ‘master plan’, organizing everything to perfection like the birth of professional accounting firms in 1970s? Reward your best performers with incentives for achieving high, like a 1990s broker? Or maybe you consider ways of working with stakeholders and social-enterprise to maximize positive impact, as suggested by the new twenty-first century sustainability approach?

The truth is that there is no corporate-finance leadership ‘magic bullet’ – but there is a way through the muddle of competing ideas. We can draw on the entire developmental history of humans and business to clarify and resolve many of the dilemmas modern leaders face.

The ‘DNA’ of Leadership Mindsets

Leadership Mindset Systems is way of understanding how humans adapt to increasingly complex life conditions. These systems shape our cultures, societies, everyday life (including economics, politics, finance industry, etc.) and how we think about topics or solve problems. They associate particular life conditions with particular leadership practices. Leadership Mindset Systems look at the ways leaders have adapted their practices through history, in order to effectively lead people and organisations in a changing competitive environment. They are fixed ways of thinking and often referred to as the social-cultural-psychological ‘DNA’ of a sector, passed down from one generation to the next.

Understanding how leadership mindsets connect to specific industries, sectors and organisations helps modern leaders make complexity simple and create sustainable strategies.

It provides a framework for understanding what might – and might not – be successful in a particular context. The leadership mindset of an organisation, leader and ‘followers’ can be studied, analysed and measured.

There are various Leadership Mindsets at play in Corporate Finance M&A. There are obvious differences between countries, and more subtle ones between organisations competing in the same sector. For example, Accenture and Boston Consulting Group, both American professional service firms, have clearly differing cultures and leadership philosophies. So too are boutique UK firms Evercore Partners and Houlihan Lokey.

Core Corporate Leadership Mindsets

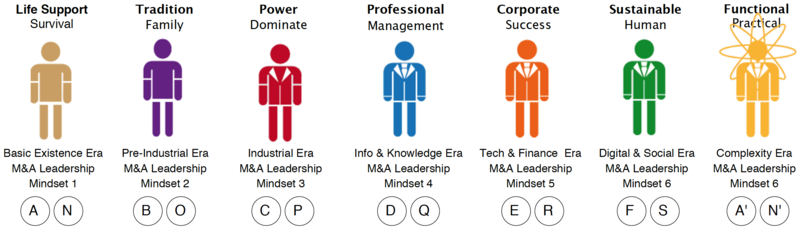

This system identifies six core leadership mindsets developed from the history of corporate finance, each rooted in different life conditions:

Life Conditions | Summary of associated leadership philosophy |

A: Basic existence era | N: Life conditions support individual survival way of thinking |

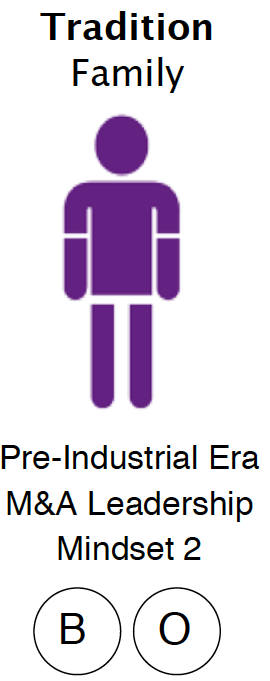

B: Pre-industrial era | O: Life conditions support group traditional/tribal way of thinking |

C: Industrial Revolution era | P: Life conditions support individual power/exploitive way of thinking |

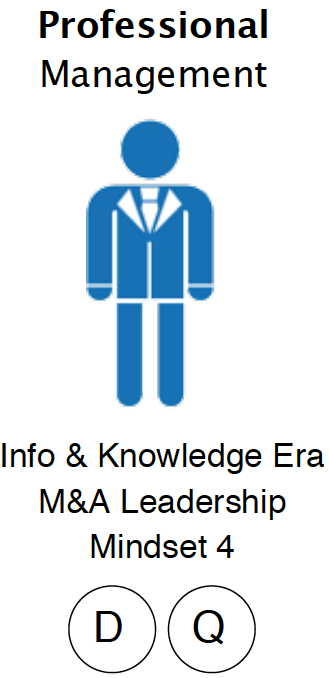

D: Information & knowledge era | Q: Life conditions support purpose/planned driven way of thinking |

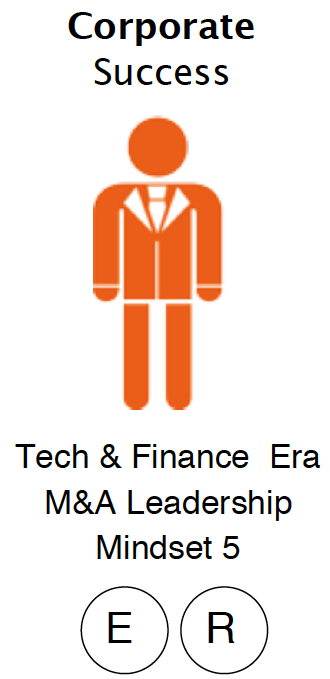

E: Global technology-finance era | R: Life conditions support individual success/achievement way of thinking |

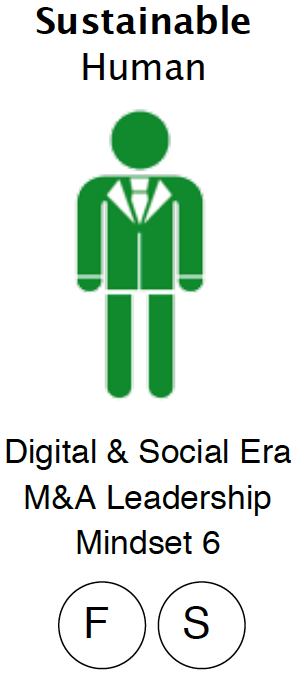

F: Digital/social network era | S: Life conditions support communal/network way of thinking |

A’: Multi-systemic era | N’: Life conditions support cognitive/systemic way of thinking |

LMS 1: Basic Existence Era Finance M&A

In (A) basic existence life conditions, the dominant leadership philosophy is (N): no leadership structure or system is present here. It is important to recognise its importance, separating Homo sapiens from animals. This is basic survival thinking: flight, fight and safety. In the modern world of corporate-finance leadership, this type of thinking is loosely associated with a distressed asset, where leaders are so stressed no decision can be made and followers hopelessly watch an asset disintegrate.

LMS 2: Pre-Industrial Era Corporate Finance M&A

In (B) pre-industrial life conditions, the dominant leadership philosophy is (O): traditional lineage, family and kinship-based. Leadership is a rite of passage by lineage or name. Leaders are associated with legends and wisdom. They are promoted to positions from within a core of semi-elites or blood relatives. They are concerned with maintaining group cohesion, values, customs and traditions. Followers organise in a circle structure around the central patriarch in a demonstration of unity and for safety.

Historic examples include leaders at the head of industrial families, merchants and kingdoms, such as trading banks, Hudson Bay Company and East India Company. They financed business through favorable relationships with the state, maturity of futures contracts and trading banks. All involved a great deal of trust. Elements of strong healthy (O) corporate finance M&A leadership exist today in family businesses or offices passed down through multiple generations.

LMS 3: Industrial Era Corporate Finance M&A

In (C) life conditions, leaders emphasise the idea of power and conquest (P). The individual with most power wins: this is the leadership of the Big Boss, expressed as superiority. Leaders climb through the ranks overpowering everyone, and hold their position by intimidating and using heavy doses of discipline. Followers organise in a top-down chain of command. Expression of these elements was normal during the U.S. and Western European large-scale industrial revolutions. Historic examples include leaders who financed massive industrial output and expansion through debt and preferred stock. More modern-day unhealthy (P) leadership elements can be seen in old-school corporate raiders, hostile takeovers and asset stripping.

LMS 4: Information & Knowledge Era Corporate Finance M&A

In (D) life conditions, following corporate finance M&A by the rules of the game (Q) becomes a central idea. Leadership is an emotional call to professionalise, do things by the book and Master Plan. Leaders are classified by rank, class or status; they demand group discipline and structure, and have a sense of purpose. Followers organise in a formal management structure where positional authority determines rank (e.g. head of department/division). Historic examples include leaders who used structured debt, financial governance and managed risk to help their corporate clients grow. Unhealthy (Q) leadership expression is now seen when extreme regulation prevents growth or, as in the case of Enron, when leadership does not provide proper disciple.

LMS 5: Tech & Financial Era Corporate Finance M&A

Where (E) life conditions predominate, leaders maximise advantages and leverage opportunities. Leadership emphasises individual ‘best of the best’ (R). Leaders are the most competent and smartest, those who have developed a special competitive advantage over others. Key elements of leadership include exploring opportunity and deploying innovative ways of taking calculated risks that reap rewards. Followers organise in a formal management structure, but where positional authority is flexible depending on competency. Examples include leaders who use LBO, strategic partnerships and innovative financial packages to finance growth. Unhealthy (Q) leadership expression is seen in the ‘Gordon Gecko’ of excessive junk-bond markets and hedge funds that pursue profit at any cost.

LMS 6: Sustainable Era Corporate Finance M&A

In (F) life conditions, leaders act as a facilitator/collaborator (S). Leadership is about being equal and bringing everyone together to deepen the human bond. Followers organise in an egalitarian circle structure. Leaders encourage performance through sustainable capitalism. Stakeholders are key elements. This type of (S) corporate finance M&A leadership philosophy is rare and just-emerging millennial thinking in an industry dominated by profit making. Current examples include leaders pioneering new areas and ways to finance deals with positive impact, including social enterprise, renewable energy and life sciences.

LMS 7: Functional Era Corporate Finance M&A

In (A’) life conditions, leaders in corporate finance M&A aim to be functional and flexible (N’). This is the present and emerging future, and there are currently few examples. Leadership is practical and leaders dip into the five other leadership philosophies to find whatever works with followers at the time, place and circumstances. Followers are not really such. Everyone is on the same page, characterised by high levels of commitment; differences between people are expected and accepted.

Above, each LVS is described individually and as a stereotype; in the real world they mix and combine in interesting ways to form the bio-psycho-social ‘DNA’ of corporate finance M&A

Leading M&A in the 21st Century

Good leaders in M&A naturally apply Leadership Value Systems theory every day – albeit intuitively, rather than through formal frameworks or measurement. Good leaders understand subtle changes in the corporate finance and business environment, and effectively work with the human element of their follower. Good leaders instinctively know which leadership styles, practices or tactics work for each of their followers.

Since the time of Darwin we’ve understood it is not the species that is the strongest or most intelligent that survives – it’s the one that can most effectively adapt to the environment.

As the pace of change increases, and corporate-finance M&A becomes more complex, there is a need to improve the skill level of leaders from ‘good’ to ‘great’. It’s an inevitable part of business evolution that the bar for quality leadership rises every year.

Written by John Grisby

Managing Partner

Grey Matter Global Ltd

Thank you John. Be sure to book for the Emerging Leaders Forum to see his panel on leadership mindsets on M&A.