Dear visitor,

You're reading 1 of your 3 free news articles this quarter

Register with us for free to get unlimited news, dedicated newsletters, and access to 5 exclusive Premium articles designed to help you stay in the know.

Join the UK's leading credit and lending community in less than 60 seconds.

IPO costs hit £4m as Cabot prepares for flotation

IPO costs have increased Cabot Credit Management’s operating expenses more than 10-fold to £4.2m for the third quarter of 2017.

Group Editor

The debt purchaser has today (November 3) published results for the three months to September 30, and while they show a pre-tax profit of £16.6m for the quarter, (up from £14.5m in the same quarter last year), they also show the expense of IPO preparations.

Cabot said its total operating expenses of £4.2m are primarily made up of IPO costs, followed by amounts related to company acquisition and restructuring.

The company confirmed last month its plans to go ahead with an IPO, which is expected to be completed in November. The financials state that Cabot expects to raise gross primary proceeds of about £195m from the IPO, which will be used for general corporate purposes.

As for general performance in the third quarter, Cabot’s collections activity increased slightly to £26.7m, from £21.1m during the same period last year. Income generated from portfolio investments increased to £68.4m from £62.5m in 2016.

Cabot deployed £255m of capital during the 12 months to September 30 2017; of this 79 percent was deployed in the UK and the rest across Europe.

Of the £201m that Cabot spent in the UK, 63 percent was on paying portfolios, 34 percent on non-paying portfolios and the remainder was on non-financial services portfolios.

In August, Cabot agreed to acquire the debt collection agency Wescot, and Cabot’s results show Wescot’s performance for the nine months ending June 30 2017.

The results show that Wescot generated £223m in collections for this time frame, with a total revenue of £29.5m. Wescot’s EBITDA was also £6.5m for this period.

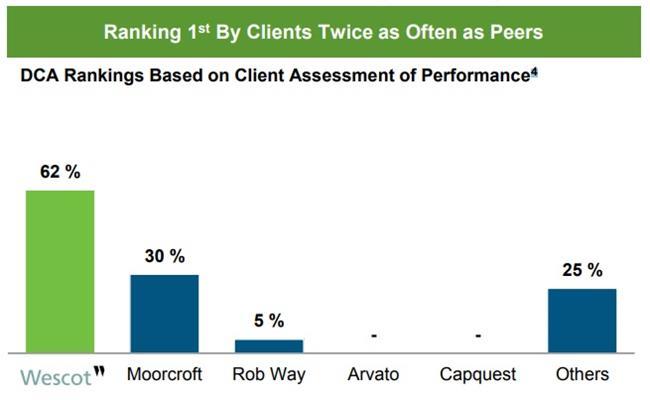

Cabot’s results also included a debt collection agency ranking chart, shown above, that was created with client information sourced from the last available management information (MI) provision, ranging between June and September 2016.

The chart shows Wescot ranked as number one by 62 percent of clients, followed by Moorcroft and Robinson Way – the latter owned by Hoist Finance.

Ken Stannard, chief executive of Cabot, said the group is performing well as it prepares to start life as a public company.

He added: “Cabot has again delivered robust financial performance as it prepares to start life as a public company.

“As we move into a higher interest rate environment, the company’s core skills and ability to identify the right solutions for customers is becoming more important than ever.”

Cabot said it has a strong pipeline of capital deployment opportunities, with 90 percent of full year expected purchases already committed, and £120m of 2018 purchases agreed via forward flow agreements.

Stay up-to-date with the latest articles from the Credit Strategy team

READ NEXT

Women in Credit Conference 2024 launches

Via Atal: Unlocking global growth

The Budget - 2p National Insurance cut confirmed by the Chancellor

Get the latest industry news